Create an Alpha Model based strategy

A different approach to strategies implementation involves the use of Alpha Models. The backtesting module contains both an abstract AlphaModel and an AlphaModelStrategy - a base strategy, which puts together models and all settings around it.

Note

Some of the concepts used in this tutorial were described in the How to backtest your strategy tutorial. It is strongly advised to review that one first, before learning about the Alpha models.

Simple Moving Average Alpha Model

Let’s write our first Alpha Model strategy. The strategy will apply two Exponential Moving Averages of different time periods on the recent market close prices of the traded asset to determine the suggested move. It should suggest to go LONG on this asset if the shorter close prices moving average exceeds the longer one. Otherwise it should suggest to go SHORT. The code of the alpha model is available in the demo scripts.

At first we need to create the code of the new Alpha Model class. In order to use the AlphaModelStrategy it is necessary to implement the AlphaModel.calculate_exposure() function, which returns the expected Exposure. Exposure suggests the trend direction for managing the trading position (LONG, OUT or SHORT).

from qf_lib.backtesting.alpha_model.alpha_model import AlphaModel

from qf_lib.backtesting.alpha_model.exposure_enum import Exposure

from qf_lib.common.enums.price_field import PriceField

from qf_lib.common.tickers.tickers import Ticker

from qf_lib.data_providers.data_provider import DataProvider

class MovingAverageAlphaModel(AlphaModel):

def __init__(self, fast_time_period: int, slow_time_period: int,

risk_estimation_factor: float, data_provider: DataProvider):

super().__init__(risk_estimation_factor, data_provider)

self.fast_time_period = fast_time_period

self.slow_time_period = slow_time_period

def calculate_exposure(self, ticker: Ticker, current_exposure: Exposure) -> Exposure:

num_of_bars_needed = self.slow_time_period

close_tms = self.data_provider.historical_price(ticker, PriceField.Close, num_of_bars_needed)

fast_ma = close_tms.ewm(span=self.fast_time_period, adjust=False).mean()

slow_ma = close_tms.ewm(span=self.slow_time_period, adjust=False).mean()

if fast_ma[-1] > slow_ma[-1]:

return Exposure.LONG

else:

return Exposure.SHORT

Let’s slowly review the implementation of the calculate_exposure function. At the very beginning we download the historical prices from our data provider. To achieve this we use the historical_price function of the DataHandler object. This function will return a pandas-compatible QFSeries.

Afterwards we apply the ewm() and mean() pandas functions to compute the fast and slow moving average. Finally, we return either Exposure.LONG when the fast moving average > slow moving average and Exposure.SHORT otherwise.

Some of the parts still may be confusing (what is the risk_estimation_factor?), but everything will be explained in later steps. Now let’s focus on running the alpha model to see the result of the strategy.

Run Alpha Model Strategy

In order to run the strategy with the Alpha Model we just created we will need to use both BacktestTradingSession and AlphaModelStrategy.

AlphaModelStrategy is a predefined strategy which puts together alpha models and all settings around it and generates necessary orders. Let’s create a script to run the strategy at 1:00 a.m. every day.

import matplotlib.pyplot as plt

plt.ion() # required for dynamic chart

from demo_scripts.common.utils.dummy_ticker import DummyTicker

from demo_scripts.demo_configuration.demo_data_provider import daily_data_provider

from demo_scripts.backtester.moving_average_alpha_model import MovingAverageAlphaModel

from demo_scripts.demo_configuration.demo_settings import get_demo_settings

from qf_lib.documents_utils.document_exporting.pdf_exporter import PDFExporter

from qf_lib.documents_utils.excel.excel_exporter import ExcelExporter

from qf_lib.backtesting.strategies.alpha_model_strategy import AlphaModelStrategy

from qf_lib.backtesting.trading_session.backtest_trading_session_builder import BacktestTradingSessionBuilder

from qf_lib.common.enums.frequency import Frequency

from qf_lib.common.utils.dateutils.string_to_date import str_to_date

def main():

start_date = str_to_date("2010-01-01")

end_date = str_to_date("2015-03-01")

settings = get_demo_settings()

pdf_exporter = PDFExporter(settings)

excel_exporter = ExcelExporter(settings)

session_builder = BacktestTradingSessionBuilder(settings, pdf_exporter, excel_exporter) session_builder.set_frequency(Frequency.DAILY)

session_builder.set_data_provider(daily_data_provider)

ts = session_builder.build(start_date, end_date)

model = MovingAverageAlphaModel(fast_time_period=5, slow_time_period=20,

risk_estimation_factor=1.25,

data_provider=ts.data_handler)

model_tickers = [DummyTicker('AAA')]

model_tickers_dict = {model: model_tickers}

strategy = AlphaModelStrategy(ts, model_tickers_dict)

CalculateAndPlaceOrdersRegularEvent.set_daily_default_trigger_time()

CalculateAndPlaceOrdersRegularEvent.exclude_weekends()

strategy.subscribe(CalculateAndPlaceOrdersRegularEvent)

ts.start_trading()

if __name__ == "__main__":

main()

That’s it! Now you can run the script and monitor how well the strategy performs!

How does it actually work?

Alpha Model is responsible for calculating Signals, using the calculate_exposure function. If you want to create your own Alpha Model, you need to remember that your class needs to extend the abstract AlphaModel and therefore it should implement this function.

In our case, every day before the market opens, the Alpha Model was:

Computing the desired Exposure for each asset (LONG, SHORT or OUT).

Creating Signals - each Signal contains information such as suggested exposure, fraction at risk (helpful to determine the stop loss levels), signal confidence or expected price move.

The generated signals are further used by the PositionSizer in order to generate and place Orders.

Now you are probably wondering what Position Sizer did we use in the example above? By default, the Backtest Trading Session uses SimplePositionSizer. This position sizer converts signals to orders which are the size of 100% of the current portfolio value.

You can try out other position sizers to see which one will fit your needs.

def main():

start_date = str_to_date("2010-01-01")

end_date = str_to_date("2015-03-01")

settings = get_demo_settings()

pdf_exporter = PDFExporter(settings)

excel_exporter = ExcelExporter(settings)

session_builder = BacktestTradingSessionBuilder(settings, pdf_exporter, excel_exporter)

session_builder.set_frequency(Frequency.DAILY)

session_builder.set_data_provider(daily_data_provider)

session_builder.set_position_sizer(FixedPortfolioPercentagePositionSizer, fixed_percentage=0.2)

ts = session_builder.build(start_date, end_date)

model = MovingAverageAlphaModel(fast_time_period=5, slow_time_period=20,

risk_estimation_factor=1.25,

data_provider=ts.data_handler)

model_tickers = [DummyTicker('AAA')]

model_tickers_dict = {model: model_tickers}

strategy = AlphaModelStrategy(ts, model_tickers_dict)

CalculateAndPlaceOrdersRegularEvent.set_daily_default_trigger_time()

CalculateAndPlaceOrdersRegularEvent.exclude_weekends()

strategy.subscribe(CalculateAndPlaceOrdersRegularEvent)

ts.start_trading()

def main():

start_date = str_to_date("2010-01-01")

end_date = str_to_date("2015-03-01")

settings = get_demo_settings()

pdf_exporter = PDFExporter(settings)

excel_exporter = ExcelExporter(settings)

session_builder = BacktestTradingSessionBuilder(settings, pdf_exporter, excel_exporter)

session_builder.set_frequency(Frequency.DAILY)

session_builder.set_data_provider(daily_data_provider)

session_builder.set_position_sizer(InitialRiskPositionSizer, initial_risk=0.05)

ts = session_builder.build(start_date, end_date)

model = MovingAverageAlphaModel(fast_time_period=5, slow_time_period=20,

risk_estimation_factor=1.25,

data_provider=ts.data_handler)

model_tickers = [DummyTicker('AAA'), DummyTicker('BBB')]

model_tickers_dict = {model: model_tickers}

strategy = AlphaModelStrategy(ts, model_tickers_dict)

CalculateAndPlaceOrdersRegularEvent.set_daily_default_trigger_time()

CalculateAndPlaceOrdersRegularEvent.exclude_weekends()

strategy.subscribe(CalculateAndPlaceOrdersRegularEvent)

ts.start_trading()

Final thoughts

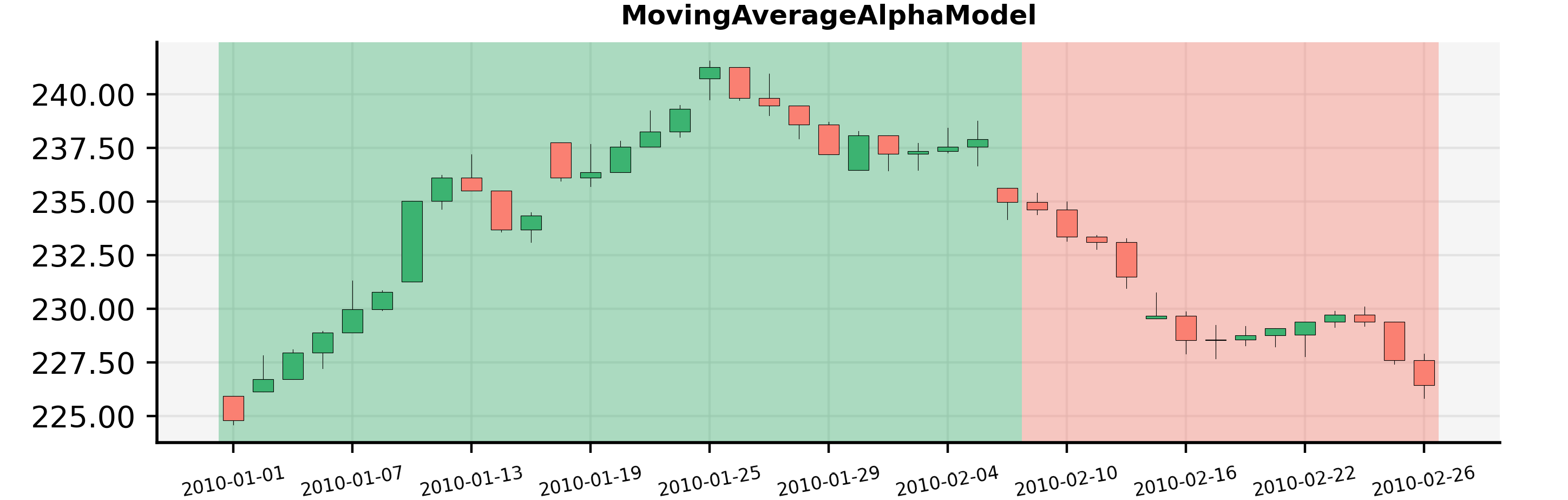

Alpha model can be a powerful tool to help you test your ideas and strategies. The backtest results usually provide a full picture of what happened every day, what was the performance of the strategy etc. In case if you would need to understand better why at certain point in time you were either LONG or SHORT, you could use a tool to plot your signals on top of a candle stick chart:

You can see here that the model was LONG for the given asset the whole January and became short around the 8th of February. To create the document with the chart you can use the following code sample:

from demo_scripts.backtester.moving_average_alpha_model import MovingAverageAlphaModel

from demo_scripts.common.utils.dummy_ticker import DummyTicker

from demo_scripts.demo_configuration.demo_data_provider import daily_data_provider

from demo_scripts.demo_configuration.demo_settings import get_demo_settings

from qf_lib.documents_utils.document_exporting.pdf_exporter import PDFExporter

from qf_lib.analysis.signals_analysis.signals_plotter import SignalsPlotter

from qf_lib.backtesting.data_handler.daily_data_handler import DailyDataHandler

from qf_lib.backtesting.events.time_event.regular_time_event.market_close_event import MarketCloseEvent

from qf_lib.backtesting.events.time_event.regular_time_event.market_open_event import MarketOpenEvent

from qf_lib.common.enums.frequency import Frequency

from qf_lib.common.utils.dateutils.string_to_date import str_to_date

from qf_lib.common.utils.dateutils.timer import SettableTimer

from qf_lib.documents_utils.document_exporting.pdf_exporter import PDFExporter

from qf_lib.settings import Settings

def main():

start_date = str_to_date("2010-01-01")

end_date = str_to_date("2010-03-01")

signal_frequency = Frequency.DAILY

title = "Signals Plotter Demo"

# set market open and close time. Does not matter much for a backtest

# signals will be calculated at midnight for daily frequency

MarketOpenEvent.set_trigger_time({"hour": 8, "minute": 30, "second": 0, "microsecond": 0})

MarketCloseEvent.set_trigger_time({"hour": 13, "minute": 0, "second": 0, "microsecond": 0})

data_handler = DailyDataHandler(daily_data_provider, SettableTimer(start_date))

model = MovingAverageAlphaModel(fast_time_period=5, slow_time_period=20,

risk_estimation_factor=1.25,

data_provider=data_handler)

settings = get_demo_settings()

pdf_exporter = PDFExporter(settings)

plotter = SignalsPlotter([DummyTicker("AAA")], start_date, end_date, data_handler,

model, settings, pdf_exporter, title, signal_frequency, data_frequency=signal_frequency)

plotter.build_document()

plotter.save()